Crypto

- What is a POAP?

- Examples of POAPs and how they can be used.

- Review the Minnebar 17 POAP distribution.

- Discuss additional capabilities and applications built around POAP.

- We will even create a POAP in the event so you see how it is done.

- How do you find the things you put in the Weekly Thing?

- How do you create each issue?

- How do you maintain consistency?

- My task template that I use for each week

- The automation that I have created to build each issue

- The overall toolchain that I use to create it

- Specific tactics to maintain sustainability of a long-term project like this

- Todd Van Nurden, Principal Developer Cloud Architect and Mad Scientist, Microsoft Technology Center’s

- Sam Pierson, Chief Technology Officer, Talend

- Tammylynne Jonas, Global CIOGlobal CIO, Donaldson

- Why now? AI has been in the works for a long time. Has there been a technological breakthrough recently?

- How does Generative AI affect how we build software.

- How does Generative AI benefit from these early releases.

- Opportunities technologists see to use this capability in their organizations.

- What are some of the risks to keep an eye on?

- AI as a coach or mentor?

- Easy to parse list of upcoming community events

- No more than three relevant links to news about the tech community

- Community Supporter Highlight, randomly share a bio about one of the community supporters each issue

- Project Highlights from Community Supporters to submit and share a project (personal, hobby, business) that they would like to highlight for everyone

- re(center)ed which provided an opportunity for people to write a message on a piece of wood and then hang it anonymously on the wall. Every few hours the curator would pull them down and burn them in a “pyre”, releasing the sentiment.

- Archive of Collective Memory that allowed you to submit a message via the web that was then turned into an audio loop and played through a wooden wall that you had to put your ear against to hear it.

- Blankets of Ice which had a bedroom set in the middle of the snow with a “quilt” pattern made of colored ice blocks.

- Chapsicle of Love provided marriage service at the event.

- Techno From the Sun was a shanty powered only by solar energy with people DJ’ing techno music inside. You could modify and add to the mix by moving levers and dials on the outside of the shanty.

- On-chain analytics, how close am I to POAP.eth via POAPs?

- Add annotation to each POAP so I can fill out the memory more.

- Notify me of POAP drops “around me”

- Notify me of any POAP Deliveries waiting for me.

- Credit for 1 mainnet migration a month.

- Issue POAP by email address, hide claim codes entirely from everyone.

- Collections/series of POAP.

- Integration with my analytics service, so embed my Phantom Analytics or other tracking code.

- Support for external identifiers in claim codes so I can embed an identifier to my systems.

- Post-claim redirect.

- Additional metadata added to each claim

- White Label claim page

- Design services, POAP specific look

- Priority support, will hit your deadline

- Assistance with claim code distribution

- Everything in POAP Pro.

- 2 Studio events a year included.

- Would need something more.

- PAOP Pro for free

- 1 Studio events a year

- Ways to make claim code management and distribution easier. When I talk with people about distributing POAPs managing the claim codes is always a burden.

- Anti-farming for issuers would be nice. I had one POAP event get completely farmed and I would like to be able to invalidate that event somehow.

- Creating images for POAPs seems like an obvious capability. POAPathon is doing this at small scale. Even for organizations that have their own designers they may want help getting that POAP-look.

- RSS has been around since 1999 and is still one of the most widely supported way to syndicate activity across the web. RSS is used by hundreds of different Feed Readers, which would be great for POAP to support. Equally important are services like IFTTT and Zapier that can take any RSS feed and use that as a trigger for automation. If every event offered an RSS feed of POAP claims, that could be used by event organizers to power a ton of automations when a token is claimed.

- Webhooks would also allow additional integrations with POAP events. Webhooks would be a great middle option between the full POAP API, and something simple like RSS. If you could register one, or even multiple, Webhooks for an event that would be triggered on a claim you could do even more powerful extensions into platforms like Zapier. Additionally this would allow an easy way for app developers to connect to POAP events and claims.

- Creating a POAP event is incredibly simple. You don’t need to even create an account, all you need is an email address. This is great to remove friction but it also means that anyone can create any event. POAP has put significant effort into the curation body and review process to make sure that events meet some basic standards. But there is no way to assert that an event is truly from the organization or event it describes. It would be great to be able to sign the event with your wallet! For example, my Birthday POAP would be more authentic if the event was signed by the thingelstad.eth wallet. This opens up a common set of issues associated with verification, but verifying that events are authentic would make those POAPs more meaningful.

- There is an opportunity to have POAPs for things that are bound to locations instead of times. There is already a POAP Geocaching app in the store and there has been at least a couple experiments like this. That would be a cool capability, but I would also think that POAPs that are well known to collect at locations would be very neat. I would make one for my house that visitors could collect (preferably signed by both thingelstad.eth and knoxave.eth!). Another use case I would love is a POAP for summiting a climb. If you removed time limitations, this would be ideal for restaurants and cafes to have a perpetual POAP you can claim for visiting their location.

- POAP events can currently be minted from a claim code, or reserved using an email address. The email option is a nice intent but it doesn’t do much. You reserve your POAP to mint later, even after the expiration date for the event. But until you mint it you will not show up on the list of token holders, and cannot do anything else. This is an okay feature but it is confusing. People tend to thing they are done after reserving with an email address. POAP should send reminder emails to nudge those that have reserved to move forward with minting. And it would be great for event organizers to be able to see reservations to help people get them minted.

- Better yet would be to have POAP provide a non-custodial wallet for users that don’t have one. This could work very similar to what Reddit has done to get Collectible Avatars working. In Reddit, you can provide your own wallet, or you can let Reddit make one for you. The wallet that it makes is completely real, and you have the choice of letting Reddit store the seed phrase to recover it, or you can manage it on your own. This would be ideal for POAP as well. With this capability you could get rid of the reservation process entirely by creating a wallet and managing it for people. If it is fully capable, like a Reddit wallet, you could even give it an ENS name and add it to a MetaMask or Rainbow if you wanted.

In the midst of a blizzard Jamie decided that it would be a good idea to take the older kids that had just finished sledding for an hour to town 11 miles away. After clearing the Mazda CX-9 of snow and getting it warmed up Jamie pulled out with Mazie, Nora, Tyler, Levi, and Elsa. The snow was deeper than Jamie expected but they made it up the driveway and turned right onto the dirt road. The road had no clear markings and with the blizzard the snow had blown over everything. There was only snow in front of us and not being able to see the road Jamie drove right off the crown of the road putting the passenger side wheels in the ditch. Mazie, Nora, and Jamie attempted to dig the wheels out and push but the Mazda simply slid further into the ditch. Hector came out to help and we proceeded to make no progress, simply sliding further into the ditch. Denny then came to the rescue with his pickup and tow strap. First attempt to pull the Mazda out actually pulled Denny’s truck into the ditch too and left him stuck. Luckily the crew was able to get the truck unstuck, and a 2nd attempt to pull the Mazda out was more successful. Denny pulled in the truck and Jamie managed the Mazda until we got all wheels back on the road. Finally, after nearly an hour, both cars returned and everyone rejoiced.

I made Olson Family Vacation 20 Blizzard Rescue to remember it.

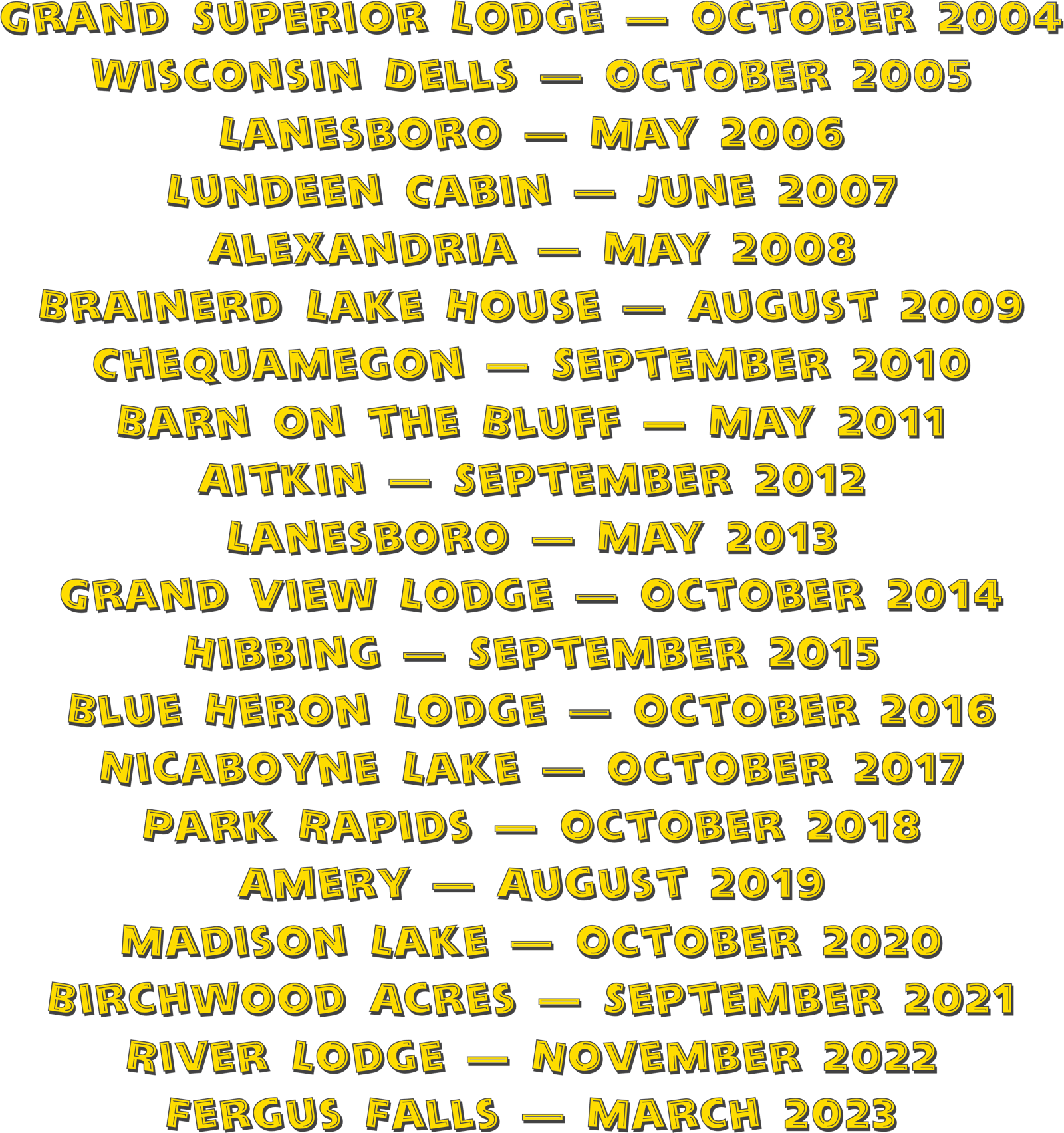

20 Years of Olson Family Vacation

This weekend we are celebrating 20 years of Olson Family Vacations. In 2004 Tammy’s side of the family decided to have everyone get together for a long weekend, and that started the tradition that has been going on two decades now.

Every year the family responsible for finding a location and planning the weekend rotates, with everyone having hosted four vacations at this point.

To celebrate two decades of Olson Family Vacations we decided to make a special shirt for everyone.

The back of the shirt records the location of every vacation.

Of course we celebrated with a POAP as well!

Hosting Minnebar 17: Creating Digital Community with POAPs

I’m going to host a session at Minnebar 17 on Creating Digital Community with POAPs! It is my first time back to hosting sessions at Minnebar in several years, and I can’t wait to share all the fun you can have with POAPs in your projects and communities. If this is interesting, sign up on the Sessionizer and indicate that you might attend this!

Now that you’ve claimed your Minnebar 17 POAPs, let’s talk about how you can use POAP to build digital community for on your own!

On June 7, 2021 I claimed my very first POAP and was intrigued. I quickly developed a love of these digital tokens that allow me to collect and remember fun events. I’ve created over 40 different POAP events for hobbies, personal use, family events, and professional.

We will cover:

POAPs are an incredible asset to create digital communities, and there is a vibrant ecosystem built around them to enhance and add utility.

Hosting Minnebar 17: How to Newsletter

Update: Sorry to say that this session had to be cancelled. We had some travel plans come up and we will only be able to attend Minnebar 17 for half the day. We are still going to do the POAP session though.

I’m going to host a session at Minnebar 17 on How to Newsletter: Lessons from 250 Issues of The Weekly Thing. This is my first time presenting at Minnebar in several years. I’m excited to do it again!

If this is interesting to you, register on the Sessionizer and indicate that you might attend this session.

I have been publishing The Weekly Thing since May of 2017. With 250 issues of the newsletter complete I’m hosting this session to share the common questions that I get about:

Additionally I will be covering:

This session will be focused on the creator and building. We will not be covering marketing, social media, or anything related to newsletter monetization or subscriptions.

Minnebar 17 POAPs

I am excited to share that all attendees to Minnebar 17 will be getting a POAP token! In addition to the traditional t-shirt, there will be a unique claim code given to everyone so that they can claim a permanent collectible from the event. 🎉

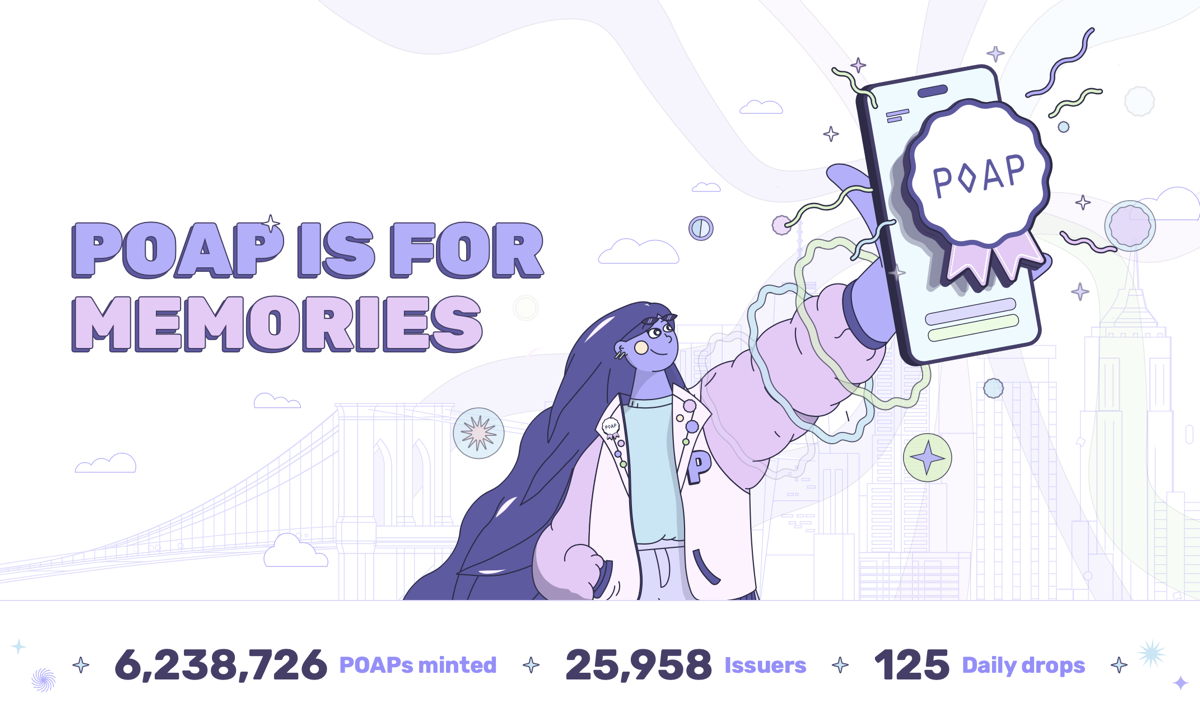

What is a POAP? Technically it is an NFT that is issued as a collectible for an event or occasion. It is like a digital version of a sticker or shirt. I’ve collected over 80 of them, see my collection for some examples.

POAP is pronounced “poh-ap”.

Update: Also see the Minnebar 17 StayNftyMpls 612 Series Giveaway!

The POAPs

There will actually be three POAP tokens given at Minnebar 17. 🤩

Attendee: All attendees will be given a claim code when they check in on arrival. Everyone that attends will get one of these.

Presenter: All presenters that sign up via the Sessionizer will have a claim code sent to them.

Organizer: All organizers who help put the event on will have a claim code sent to them.

Any holder of these POAPs will also be eligible to enter into a raffle at no cost to win something special. Stay tuned for more information on that!

I also plan to have my personal You’ve met thingelstad.eth tokens ready for distribution. Ask me for one at the event. 😊

How to get ready?

If you want to get ready ahead of time so that you can claim these easily you can do two things.

First, you need an Ethereum wallet and address. If you don’t have one, I highly recommend using Rainbow on iOS or Android. It is a very well done wallet and is simple to setup and get started with. It is totally free.

Once you have an address you are ready to go, but if you want to make it even easier you can install the POAP App too. This is also available on iOS and Android. If you configure this with your wallet address you can automatically claim a POAP just by scanning a QR code or tapping an NFC device.

Questions

What is a POAP?

POAP stands for Proof of Attendance Protocol. The POAP website has a good explainer. Functionally they are ERC-721 tokens issued on the Gnosis blockchain. The smart contracts for POAPs have a number of additional applications built around them to add additional utility.

How much does this cost?

Nothing. No funds or crypto are required to collect as many POAPs as you want. All gas fees for minting the POAPs are covered by POAP.

What is the environmental impact?

POAPs are issued on the Gnosis blockchain which uses a proof-of-stake validator mechanism similar to modern Ethereum. As such, it uses minimal power.

Can I sell the POAP?

POAPs are meant to collect and curate memories, not make money. It is strongly discouraged to sell a POAP, but technically you can. As an ERC-721 NFT you can send POAPs from one wallet to another on Gnosis chain. You can also migrate the POAP to Ethereum mainnet, however there is a 0.1 ETH fee for doing that which is largely intended to keep people from attempting to sell them.

Why do some POAP owners have names?

POAPs are held by wallets, and if you buy and configure an Ethereum Name Service name the wallet address can be displayed as a name. If you would like to do this, go to the ENS app and buy your preferred name, remember to set the reverse address lookup, and your name will be shown instead of an address.

If you have other questions, check out the POAP Help Center.

Transferring NFTs in Bulk

After I created additional Ethereum addresses for specific applications, I wanted to move existing assets to align with that.

Ethereum Name Service

Moving ENS names is a special case. The ENS address is itself an NFT, but you cannot just send these to another address. You can move them, but you have to do it in the ENS application. For each of the 21 ENS names I have I did an on-chain transaction to move them to ens.thingelstad.eth. It was easy to do, and even though there was no bulk operation it wasn’t hard to do. Each move incurred some gas fees.

POAPs and NiftyInks

With over 70 POAPs to move I really didn’t want to do these by hand. And with over 730 Nifty Inks it was out of the question to do it by hand. I looked at how to move POAPs and the FAQ recommended uNFT Wallet. I connected my wallet via Gnosis Chain and uNFT Wallet already had the contract address for POAP and Nifty Ink. I was able to move most of my POAPs with one transaction and a second after doing a test. They are now in POAP.thingelstad.eth.

I had never transferred POAPs between accounts and it is interesting that these now show on POAP as have 2 transactions. Some POAP apps like Salsa no longer show the same connections after doing this. I think that is fine, but it is worth noting.

It was less simple with Nifty Ink since I was moving over 730 NFTs. uNFT Wallet refused to even try and move all of them in one go, and there wasn’t a way to select 100 NFTs at a time. So I had to click groups of 60-90 of them and do a transaction each. After doing several of these, there were a handful of stragglers left that I actually used Nifty Ink to send to the other wallet. They are now all in niftyink.thingelstad.eth! 🎨

Thanks uNFT Wallet

There is no way I could have done this without a bulk tool like uNFT Wallet. It was an easy choice to buy one of their Limited Edition supporter NFTs to help support the project.

Isolating Crypto Assets and Access

For the last couple of years I’ve done all of my Ethereum activities using my thingelstad.eth address with the associated identity. I’ve used this for storing value, holding NFTs, collecting POAPs, and everything else. I decided that it was time to create some isolation of access and identity.

I’m still using thingelstad.eth as my primary address and means of authenticating with various services. It also holds a number of my NFTs and crypto assets. But I’ve also now created two activity-specific addresses.

mint.thingelstad.eth is the address that I’m using specifically just to mint NFTs. When you mint NFTs you have to authenticate with a new smart contract and usually provide some form of limited access to your assets. By using a dedicated address just for minting I can limit the risk of a malicious smart contract.

vault.thingelstad.eth is the reverse of the minting address. This address is specifically to hold NFTs or other assets that I have no intent of selling or transferring. This address will never be used to authenticate to any website. All activities here will be done using wallet transfers.

Additionally, I decided to create some specific addresses for applications that I use a lot. This was inspired in part from Vitalik’s conclusion:

That said, it is my view that wallets should start moving toward a more natively multi-address model (eg. creating a new address for each application you interact with could be one option) for other privacy-related reasons as well.

I love the idea of wallets automatically associating a unique address with each application. I do this today by using a masked email addresses with Fastmail and passwords managed by 1Password.

ens.thingelstad.eth is the address I’m using to hold my Ethereum Name Service registrations. ENS has built in capability for one address to register a name, and the control of that name to be delegated. So all of my 21 registered ENS names are now owned by this address, and control of them is delegated to thingelstad.eth. The only app that will ever connect to this address is ENS itself, which protects my name registrations from malicious actors.

POAP.thingelstad.eth is an address I’ve made just for collecting POAP tokens. I currently hold 90 different POAP tokens in this address. This allows me to have a specific identity and address just for POAP usage. Most activity for this address is on Gnosis Chain since that is what POAP uses natively.

niftyink.thingelstad.eth is an address just for using Nifty Ink. I’ve collected 736 “inks” on this site and now I have them isolated into an address that I only use for that purpose. 🤩 This is again a way to limit access from a malicious smart contract.

Technically I also have reddit.thingelstad.eth but was created by necessity since Reddit Vaults are managed differently. However, it serves the same pattern as the other application specific addresses.

I minted Cat #2230 of the Ukraine Cats Division. This NFT project is raising funds to help Ukraine defend itself. I think I’ll mint a few more and get a Ukraine Cat Platoon going. 😸🇺🇦

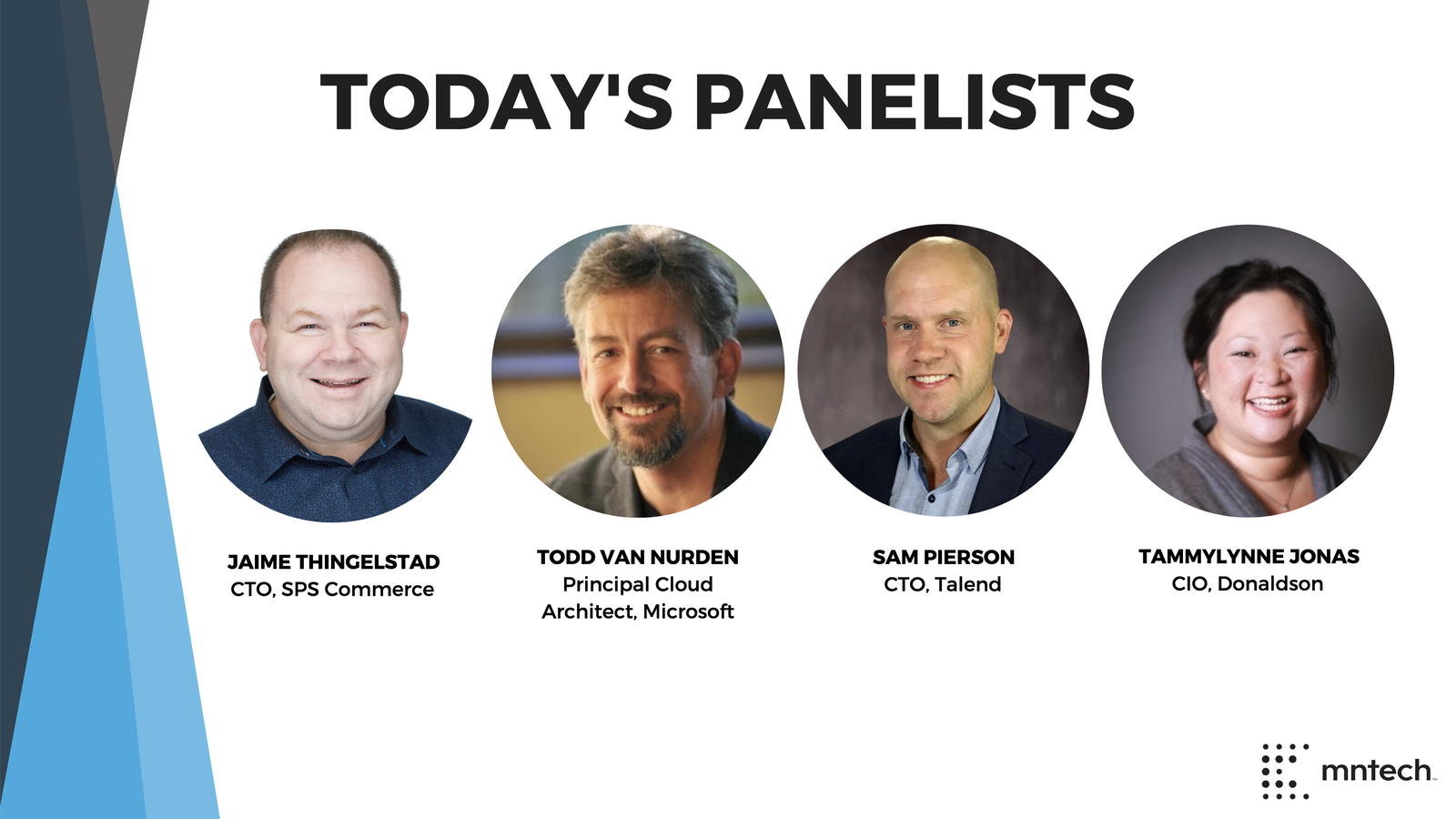

MnTech Leadership Forum: Generative AI

Today I hosted the MnTech Q1 2023 Tech Leadership Forum. The organization is changing the format of this event to have technology leaders run these quarterly forums. I thought it would be fun to focus on the topic that is making so much press lately — Generative AI: Harnessing Disruption into Innovation.

I was lucky enough to get three others to join in the dialog:

Some of the topics discussed:

Since it was an invite only event for members there isn’t a video to share. 😕

Of course there is a POAP for the event! And even more exciting, the POAP is also held by POAP.MnTech.eth which is the first POAP that MnTech is officially producing.

I Adopted Thinking Face Emoji

I ran across this Adopt a Character campaign from the Unicode Consortium and felt like a donation made sense. But what emoji to pick? After thinking through a few I decided Thinking Face. 🤔

This is fun, but I think it would be so much cooler if this program worked by selling NFTs. It has all the right characteristics with Gold and Silver levels being limited, and Bronze being “open editions.” It would be really fun to have this in my wallet as proof of participation.

Extending the Minnestar Community Supporter Program

In a recent conversation with Minnestar Executive Director Maria Boland Ploessl I was very pleased to hear about the amazing growth of the Minnestar Community Supporter program. Community Supporters were something that we launched when I was on the board of Minnestar to create an opportunity for individuals to support Minnebar and Minnedemo, in addition to companies. It was always significant, even on the first year, but it has grown a lot in recent years. The biggest part of that growth has been the structured year-end giving program which I was happy to be a matching supporter of this year.

The growth is awesome, but the program itself hasn’t changed materially since the launch. The primary benefit of being a Community Supporter is that you are guaranteed a ticket to the highly in-demand events that Minnestar hosts. That is a great benefit, but I’ve always wondered what more could be done for this great group of people that are helping support our technology community. Particularly what could be done outside of events.

In my opinion, being a Community Supporter of Minnestar should be table stakes for any technology leader in the region. It should be the most direct way to give back to the technology community we are all part of, and provide meaningful value to the supporter individually. I think supporting the events and community is solid, but the only meaningful value to the individual is a guaranteed ticket.

So what more could be done to grow the program? Some ideas…

Create Connection

People that become Community Supporters are a pretty special and fun group. Creating more connection in that group could be incredibly valuable. This could be done with in two phases.

First, launch an every-other week newsletter just for Community Supporters. This newsletter could include:

The newsletter could be the whole thing, but if there is an increase in engagement a forum for Community Supporters could get traction. I specifically do not mean Slack or Discord. Those are far too high engagement. A platform like Discourse seems much better suited to this. I think Minnestar could benefit from a Discourse like platform for everything, with Community Supporters being a member only section.

Membership

There needs to be more ways to show a persons affiliation with Minnestar, and recognize that support. I’ve been a Minnesota Public Radio member since 1995. How do I know that? My member card says it. I’ve been an Electronic Frontier Foundation member since 2010. It’s on my member card.

First step of this should be to issue an actual Minnestar Community Supporter member card. Cards have to be printed, they expire, etc. There is effort to do this but it gives me something to carry with me and show my membership.

This should also be extended into the digital world with POAP tokens. There should be a POAP for each year given to community supporters. Over the years, you collect each yearly POAP.

This would also be an opportunity to highlight the work of a local artist and create a uniquely designed card and token each year that isn’t just membership, but something that people feel like collecting.

I’ve been a Community Supporter member since the program started, but I have no idea how long that has been!

Input & Direction

Community Supporters as a group could be given the opportunity to have input on Minnestar activities. As a group votes could be taken. Thought would have to be given on what the votes are on. There is a Minnestar Board and various committees, and they should continue to do what they do. But there could be decisions that the community supporters are asked to give a vote on.

I had long thought that it would be really great for one of the Minnestar board seats to be a Community Supporter seat. In this case, the Community Supporters would elect amongst themselves one member that would represent them on the board. This could be facilitated via the forum above, with members raising their hands to serve and make their case followed by an official voting period.

This would lend itself exceptionally well to a Minnestar DAO, with membership gated via the Community Supporter POAP that you receive each year.

Ecosystem Benefits

It would be interesting to explore ways that other organizations in the technology community may want to extend benefit to Community Supporters of Minnestar. This is one of the key reasons to create Membership with a card and a token. Perhaps Twin Cities Startup Week would offer some unique opportunity. Or Tech.MN give a discount on membership. Or early access to certain events.

This would require that Minnestar reach out to have conversations around this with other events, and require proof of being a Community Supporter without access to Minnestar resources. I think this could work, and may be welcome from other organizations as well.

Art Shanty Projects

We went to the Art Shanty Projects on Lake Harriet today. Tammy has been to this many times, but it was my first. I do like events like this that make for fun days in the cold of winter. The Shanties themselves were very cool. Notable highlights:

I was left wanting to have a Shanty next year that distributed a POAP and allowed people to record a memory of the event in some way. 🤔

Echo Forest Launch

Today is the launch of Echo Forest. This NFT project has Minneapolis connections being led by Brooks Clifford and Matt Benesch.

I minted two Wolf Healers, 18 and 19. I really dig the artwork and I’m excited to see how the utility evolves. Plus it is a great opportunity to be involved in a local project.

POAP Family

The new POAP Family feature is a cool way to see what POAPs people share between events. I looked at holders of my 50th Birthday POAP and I was surprised to see that there were 7 Cryptog’s HODLER’s who had my birthday POAP. The biggest were 13 of the 34 that also had my 51st Birthday POAP.

This kind of graph analysis of POAPs is an interesting extension and a way to build connection.

POAP as a Business

POAP is more than just a fun crypto product, it is also a business. I put some brief thoughts together on what I thought would be a POAP product that I would pay for as both a collector and an issuer.

As a POAP collector, I would want to pay a relatively small monthly fee to be able to get cool information about my collection and display it well.

POAP Collector - $3/mo

Now, changing hats to the issuer side there are a whole different set of things. What if we just kept everything as is, but added a new POAP Pro level.

POAP Pro - $20/mo

I think you could then have a service to provide a “full service” experience for the issuer.

POAP Studio - $500/event, require Pro subscription

And then you could turn both the Pro and Studio option into a subscription offering.

POAP for Business - $100/mo or $1,000/yr

And lastly, I think non-profits could be a really great avenue to get the word out about POAP. Aligning with non-profits would reach a very solid set of organizations that could benefit from POAP, and be a wonderful brand alignment with POAP itself. Make it super cheap or free for non-profits to use advanced POAP Pro and Studio capabilities.

POAP for Non-Profits - $20/mo or FREE

POAP Extensions

I was pondering cool things that POAPs could have and three ideas came to mind.

POAPs with Backs!

POAPs are a bit like challenge coins, and physical coins have a front and a back. Why not support two images for POAPs so they have a front and a back. This would be cool to flip them around and see the other side. It could be a whole new place to have creative imagery!

POAP Collections

I’ve gotten a few POAPs that are officially part of a collection. The Ethereum Merge and POAPathon Krampus PAOPs are examples of this. It would be cool if there was an official collection that these were part of and that was part of the event pages. You could even unlock a collection POAP when you have all the POAPs in that collection. Some groups do that now but it is manual.

Unique POAPs

I would love to get a POAP every time we do an escape room. But it would be even cooler if my specific instance of that POAP had additional data like the time it took for us to escape, how many clues we used, and our team name. If an issuer could add one off metadata to a specific claim code it could unlock a ton of use cases.

Premium Features for POAP Issuers

I got this survey to provide some feedback on features for POAP issuers but it didn’t have any comment areas, only quantitative inputs. So I put my comments in a blog post.

Priority Support

This could be valuable and probably only for non-personal use. If it included design assistance as well that could make it more appealing, something akin to POAPathon. If bundled into a “full service” experience I think there are companies that may pay for this.

Event Promotion / Verified Event

I think verification using signatures would be great. I’m not sure what type of verification and promotion this would be, and the devil is in the details here. POAP should avoid the problems that come from things like a “suggested user list”. Also, since POAPs are about attendance, I don’t know that it is useful to get a feed of events I’m not attending.

Collector Messaging

Two-way messaging with people that hold POAPs could be interesting, but it feels odd to do this with POAP versus Discord or Reddit. It feels more likely that you would token-gate a different service for this.

Collector Notifications

One-way messaging to collectors of your POAPs would be great. For sure this would be a really big win. When I’ve explained to people how they can use POAPs at their events nearly everyone wants to use it to communicate and that isn’t possible today.

Custom Page Designs / White Labeling

For non-personal use I think this could be nice if it were relatively easy to do. I’ve done a number of POAPs for different organizations and nobody has asked about this, but if you were doing a lot of them this could make sense.

Post Claim Redirect / User Redirect

A redirect could be nice, but I think it would be sufficient for most use cases to be able to have a event setting for a URL for people to go to after claiming. Would not need to be an automatic redirect. This seems like a nice convenience feature, something similar to what most mailing list platforms do.

Drop Analytics / Drop Reporting

Analytics on events could be interesting, but these features need to all be at the wish of the issuer. I value privacy, and would want my drops to be the same way.

There are two dimensions to this too. One would be extending existing web analytics to the drop pages. That could be very helpful for some issuers.

On-chain analytics have a potential to be much more uniquely interesting. It could be valuable to know what POAP events people are connected to and what NFT projects those same users engage with. I do not like the idea of tracking anything relating to net worth value.

There were three topics that didn’t make this survey that I would also like to see.

POAP Wishlist

POAP (pronounced poe-app) is one of my favorite crypto application. There is a good overview of what POAPs are for. I think POAPs are a great way of capturing memories and events, and potential creating connection and community. I love that they are a crypto app that has no monetary component. I’ve created many POAP events as well as collecting many.

I love how POAP has gown thus far! The growth has been amazing and the organization has continued to create meaning and value. There are three areas that I would like to see POAP extend and wanted to explore in more detail.

Integration Hooks

POAP has an existing API which is great for people looking to create applications using POAPs. However, there is a bigger opportunity for POAP to offer simple integration hooks that could be used by many services and people to extend as they please.

Event Enhancements

POAP events themselves are pretty simple today. They have a summary, image, location (text), a URL, and relevant date information. Events could be enhanced in two material ways: authenticity and different types of events.

Web2/3 Onboarding

POAP is a great way to introduce people to crypto. I have personally introduced well over 100 people to crypto by giving out POAP tokens for various events. I’ve put together a very simple guide for people to claim their first POAP, including setting up a wallet! But more could be done here to make it easier for people.

I’m sure that POAP has a long roadmap and more things to work on than they have time to do. I think it would be great to see enhancements like the above because I think they hit on key areas that would drive POAP growth and adoption.

Enabling integration capabilities would allow POAP issuers to do things like send a Tweet every time a POAP is claimed. Additional authenticity would allow more confidence in POAPs, particularly if POAP Checkout is used to raise funds for a good event. And taking on more of the wallet tasks for users would make onboarding new people to POAP so much easier.

See also POAPathon Future Thoughts.

I’ve tried multiple times to participate in the KZG Ceremony for Ethereum and it times out after hours of waiting. The wait time is 10,143 minutes right now (7 days)!