Crypto

Forays into blockchain, NFTs and POAPs live here. I write about minting POAP tokens at family events, celebrating Ethereum’s 10‑year anniversary by creating an NFT and even using monitoring services to keep my POAP feeds up and running.

- There are a few of my son’s pieces mixed into the series titled “Little Man Specials.” This was a nod to those parents out there fighting to keep the creative spirit alive. He was captivated by the project and inspired to start plugging away on his own versions.

- I also had some heavy hitters that didn’t quite make the cut… Matt’s, CC Club, Electric Fetus. I can’t remember why exactly they weren’t included. I felt a sense of pressure to get the work out there and be one of the first Minneapolis inspired collections on-chain.

- While there was beauty in the limitations of the 612 pixels, there were also some challenges in getting the landmark at the right scale / perspective.

- What will this do to Bitcoin demand?

- What does this mean for MicroStrategy (MSTR) as they are effectively a Bitcoin holding company (in part) now.

- If this “legitimizes” Bitcoin, what is the follow-on to Ethereum? And other blockchains?

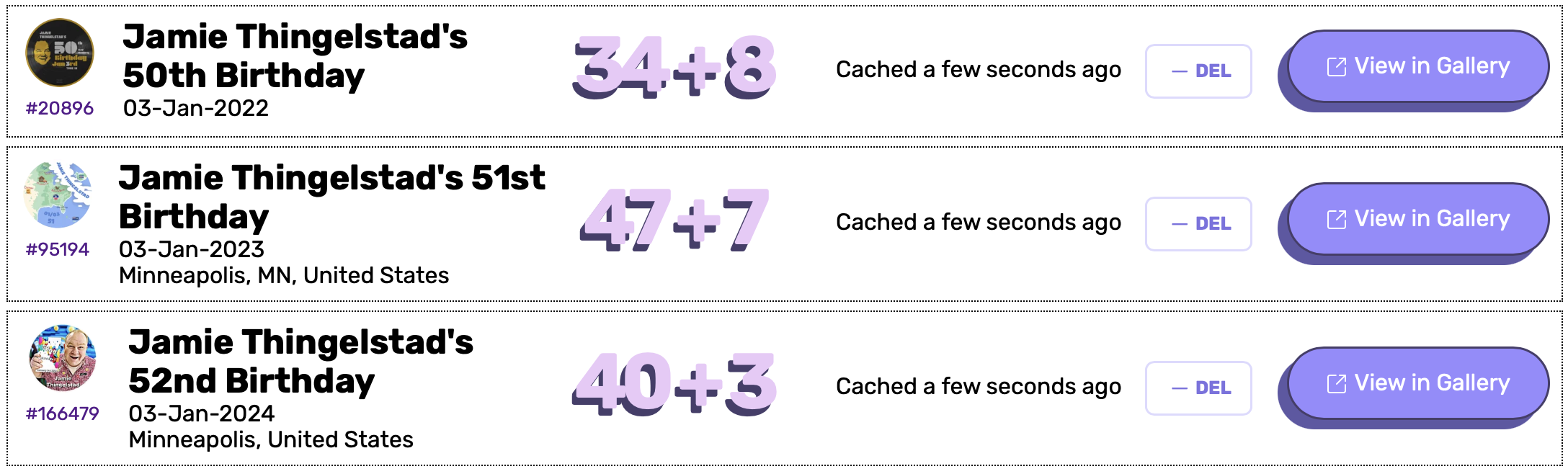

- There are 12 collectors that have all three.

- There are 21 collectors that have the most recent two.

- A total of 85 collectors have at least one of my birthday tokens.

- There are 8 reservations from 2022 and 7 from 2023 that have not been minted.

The #TeamSPS tech team gave out this “I Stopped by the Tech Lab at SKO POAP” in the Product Partner Fair at Sales Kickoff 2024. We continue to have fun with POAP.

POAP 6989234 at I stopped by the Tech Lab at SKO.

POAP 6980682 at 2023 Global Voices 100%.

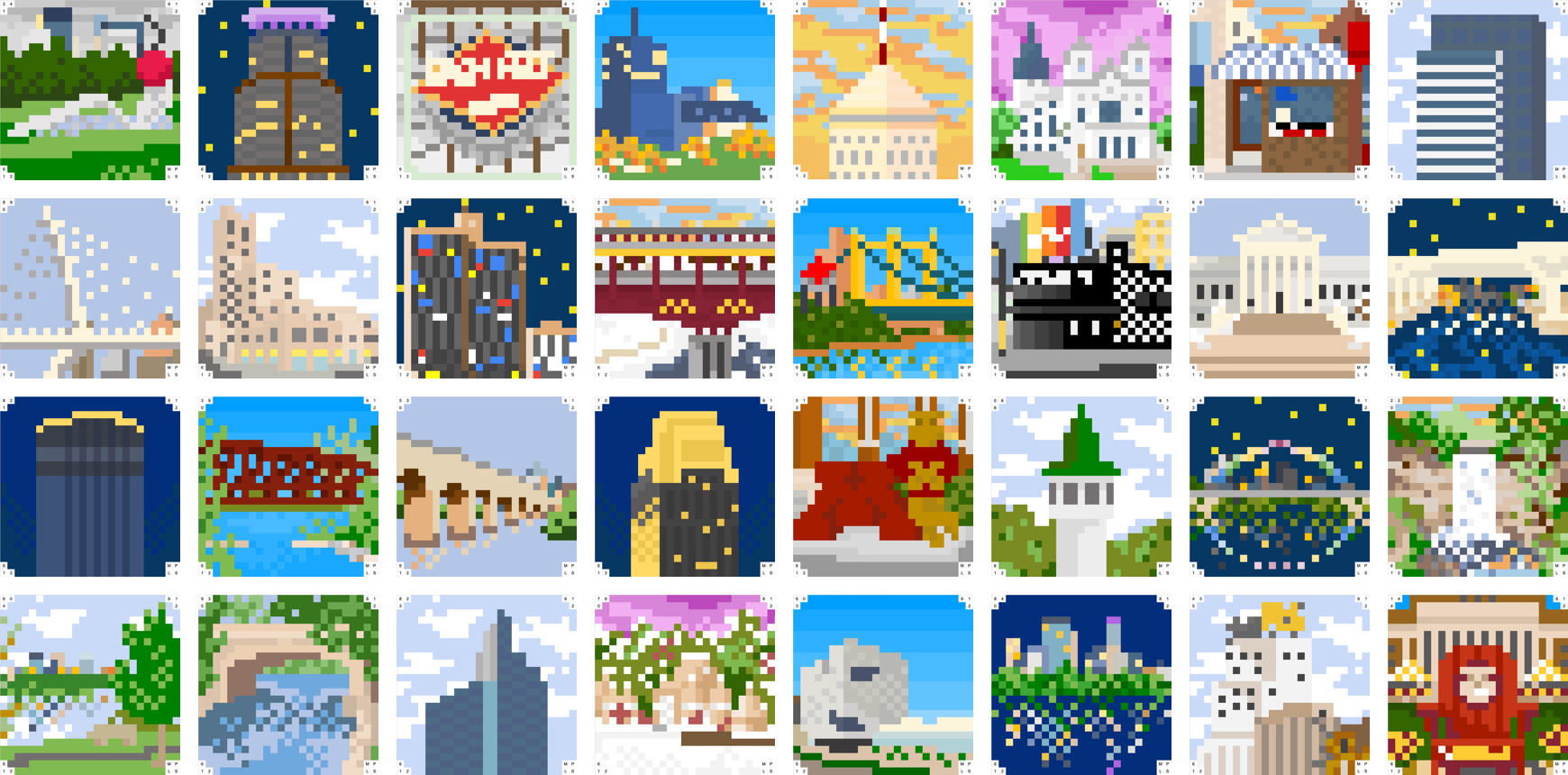

Interview with 612 Series creator Erik Halaas

In October 2022 I found the 612 Series by Erik Halaas. This NFT collection resonated with me as a Minneapolis resident. I knew nearly all the landmarks and had fond memories of many of them. I decided to purchase five of them, which turned out to just be the start. I also shared the collection with others and even sent one as a gift. Eventually I acquired a complete set of the landmarks and got to know Erik, the creator of the 612 Series and StayNftyMpls. Erik even agreed to donate a collection for Minnestar to give away in a POAP drawing at Minnebar 17.

I had some questions about the 612 Series so I asked Erik if he would be up to do an interview to dive a little deeper. He was happy to, so here we go!

Q: What was your inspiration to create the 612 Series?

A close friend of mine extended a loose invitation to an art opening in NYC in the fall of 2021. Being cooped up in the midst of the pandemic, I was itching for an adventure and didn’t need much of an excuse to hit the road. I loosely heard of art “on-chain” and the growing energy around NFTs but knew nothing of the artist, Jeff Davis co-founder and Chief Creative Officer at Art Blocks, or the folks orchestrating the show, Bright Moments a DAO curating, promoting, and producing unforgettable physical showcases centered on creating art live, on-chain, in real life.

NYC would be the 2nd stop on their 10 city journey around the world, an effort to build a thriving community of “CryptoCitizens.” At face value, it was a growing collection of simple and silly pixelated characters but there was something more there. Folks were having powerful shared experiences in person (this meant a lot in 2021), being exposed to seasoned and often unsung artists, and learning together by exploring uncharted territory (e.g. crypto, NFTs, generative art).

Long story short, I left NYC with a strong desire to replicate this energy back home — to dust off my long-dormant creativity quelled by kids and full-time work; to build community with fellow creatives, curators, and collectors; to explore this new world of digital art, NFTs, and the value of content on-chain; but to do it in a way that was specific to my home, Minneapolis. As we waited for the plane, we were talking about the immense pride folks have in the city of Minneapolis and how we might capture it. We joked about “the 612” and something clicked…

What if I made 612 Minneapolis characters? Unique snapshots? Landmarks? What if we leaned into the pixelated energy of the era and confined the creation of each landmark to only being 612 pixels?!

The project was born from there.

Q: How did you pick the landmarks to include? Do you have a favorite?

The first was the Witches Tower — a favorite landmark from my childhood growing up in Prospect Park and one of the most beloved block prints I created years ago. I had played around with a pixelated version of the tower before the NYC happenings. With all that in mind, it is probably one of my favorite 612 Series landmarks.

From the Tower, the landmarks were essentially pulled from personal or shared Minneapolis memories. The city skyline, favorite parks or lakes, iconic bridges, memorable events, concerts, or shows. Whether historic Minneapolis landmarks or simply places I had visited and revisited with family and friends at various points throughout my life, these were all places etched in my memory as representative of home. I thought about crowdsourcing folks for key landmarks but the following for the project just wasn’t there.

A couple of fun notes…

Either way… there are definitely some could’a, should’a, would’a landmarks out there.

612 Series Landmarks: Minneapolis Institute of Art, Guthrie Theatre, Lowry Ave Bridge, Stone Arch Bridge, The Walker, Witches Tower, Cherry and Spoon, I-35W Bridge, Hennepin Ave Bridge, Lake Harriet, Lake of the Isles, Minnehaha Falls, Basilica of Saint Mary, Bde Maka Ska, Lake Hiawatha, Lake Nokomis, Washington Avenue Bridge, Martin Olav Sabo Bridge, Campbell Mithun Tower, First Ave, Capella Tower, Foshay Tower, Gold Medal Building, Goldy Gopher, Grain Belt Sign, IDS Tower, Midtown Global Market, Northrup Chair, Riverside Plaza, Target Headquarters, Wells Fargo Center, Al’s Breakfast, and The Kid’s House from Purple Rain.

Q: What software and tools did you use to create the series?

Funny enough, the work was all created in Excel. As someone who has traditionally worked with relief block printing as a creative outlet the switch to digital was a stretch and, thanks to work, Excel offered a familiar toolkit. I had also heard of other artists using excel for their work — be it code-based generative art or simply documenting cross-stitch patterns.

I decided to put the project on the Ethereum blockchain because it was something I was familiar with given Bright Moments and ArtBlocks use, and OpenSea, which operates on Ethereum, was growing in popularity at the time, offered a no-code entryway to the market, and supported “lazy minting” which allowed me to put the collection up at no cost by deferring the gas fees associated with minting the piece to the buyer (“minting” is the process of officially writing the piece onto the blockchain).

Q: What plans or ideas do you have to bring the 612 Series beyond pixels? You’ve done some paintings?

I worked with a group of folks a little over a year ago to explore the interplay between digital and physical work. We hosted a dozen local creatives, half of which had a presence on-chain and the other half with no experience with NFTs, crypto, web3, whatsoever. The end result was a curated experience weaving traditional 2D and 3D mediums in with a variety of tech forward, digitally inspired content at the Hewing Hotel gallery. You can learn about the artists and get a flashback via this collection of Instagram Stories. It was a blast!

To highlight the 612 Series, I shared the initial relief block print of the Witches Tower that inspired the imagery for the series alongside an Infinite Object frame displaying a variety of the 612 Series Witches Tower NFTs. The show actually motivated me to revisit the original block printing method but reimagine the landmark in its pixelated form. I have gone on to create a few more of the landmarks in both the original and pixelated block print form (including one for you!) and would love to continue exploring how the pieces can be reimagined in the physical.

Q: If you fast forward a decade how would you like the 612 Series to be thought of?

I took great pride in being the first Minneapolis-centric NFT collection. Part of the importance of that to me was experimenting with blockchain technology and the capacity to track the work over time. Putting the pieces on chain memorialized this moment of creative inspiration and will allow me to track how interest and engagement with the collection grows, changes hands, ebbs and flows, is valued, etc. I know, for example, the exact moment that first piece moved and will know if, when, and loosely to whom that piece is handed off to down the line.

I would love to see this added narrative behind the original work build beyond simply documenting transactions — perhaps a way for holders to document and share the stories, memories, experiences that connected them to each of the landmarks they own. There was some of that starting to take place on social media.

Ultimately, these softer social interactions were the real impetus behind the project: to build community and spark creativity. This has been realized through “in real life” experiences like the show at the Hewing Hotel, collaborations with you at Minnebar 2023, connections with MN Blockchain, and so on.

My hope is that the project will continue to inspire local folks with a shared interest in the arts, technology, and community to connect, collaborate, and create locally!

A big thank you to Erik for creating this series and for sharing more about it. I wonder if we will ever see a 2nd collection of the 612 Series with a new set of landmarks? Or maybe some ability to work with Erik and create a special 1 of 1 for a set of unique landmarks in the 612 Series. How cool would it be in fifty years to see bronze plaques setup at the various landmarks highlighting these early NFTs that commemorate that spot.

Want to own a piece of this collection? There are still many 612 Series collectibles available to buy! 🛍️

To connect with Erik you can find @ErikHalaas on X, his LinkedIn profile, or via StayNftyMpls.

Wallet of Satoshi Stops Serving US Customers

It was about a year ago that I made my first purchase with Bitcoin Lightning. It was a tasty cappuccino from a vendor at Bitcoin Miami. I had read about Lightning but hadn’t had an opportunity to use it before. I was blown away by how fast and easy it was to do realtime, peer-to-peer transactions. The first Bitcoin Lightning wallet I used was Wallet of Satoshi.

I’ve continued to use Bitcoin Lightning. Unfortunately not for payment of goods. But my son has a Lightning wallet and we exchange funds with Lightning regularly. I’ve also onboarded at least 20 different people to Bitcoin by having them install Wallet of Satoshi, and then I put 1,000 sats (Satoshis, or 1/100,000,000 of a Bitcoin) in their wallet. It is simple, fast, and an eye opening experience.

All of this is to say that I was sad to hear about a month ago that Wallet of Satoshi is not going to operate in the United States anymore.

Here is an excerpt from their post on Nostr:

We’ve dedicated ourselves to providing the best Bitcoin experience with Wallet of Satoshi, being at the forefront of Lightning usability and adoption. However, we’ve made the difficult decision to remove our app from the U.S. Apple and Google app stores, and will not serve U.S. customers going forward.

They aren’t specific about why they are doing this. I suspect it likely has to do with Know Your Customer requirements. Wallet of Satoshi doesn’t require anything. You can just install it, receive funds, and send funds. It is super simple.

Since they are not allowing transfers into US accounts I sent all my sats from Wallet of Satoshi to my Strike account, via Lightning of course. It was fast and free. No worries. I’m going to keep Wallet of Satoshi installed and hope that someday in the future I can again start using my favorite Lightning wallet. ⚡️

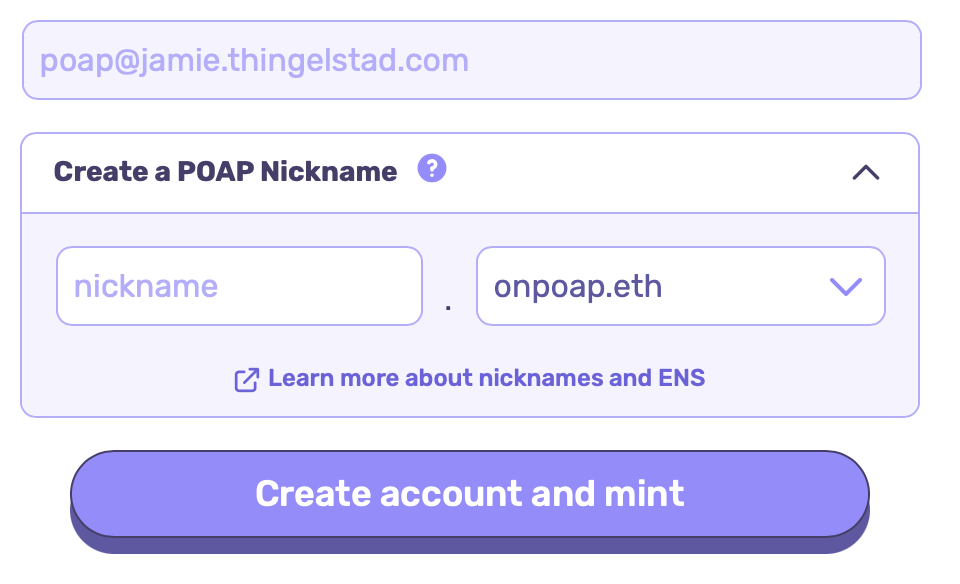

New POAP Onboarding Process

A year ago (exactly!) I shared my POAP Wishlist which included three areas that I felt would be great additions to POAP. It is a year later and I still think POAP is a wonderful product, and I continue to issue and collect these proof of attendance tokens.

One of the areas that I called out was Web2/3 Onboarding. Specifically I noted that while token claim codes could be used to reserve a POAP (not minting it), the reservations themselves weren’t actionable. There was no email engagement to encourage the person that reserved it to mint the token. I also highlighted that POAP should make it easier for people that do not otherwise have an Ethereum wallet, and create a non-custodial wallet for them to use instead.

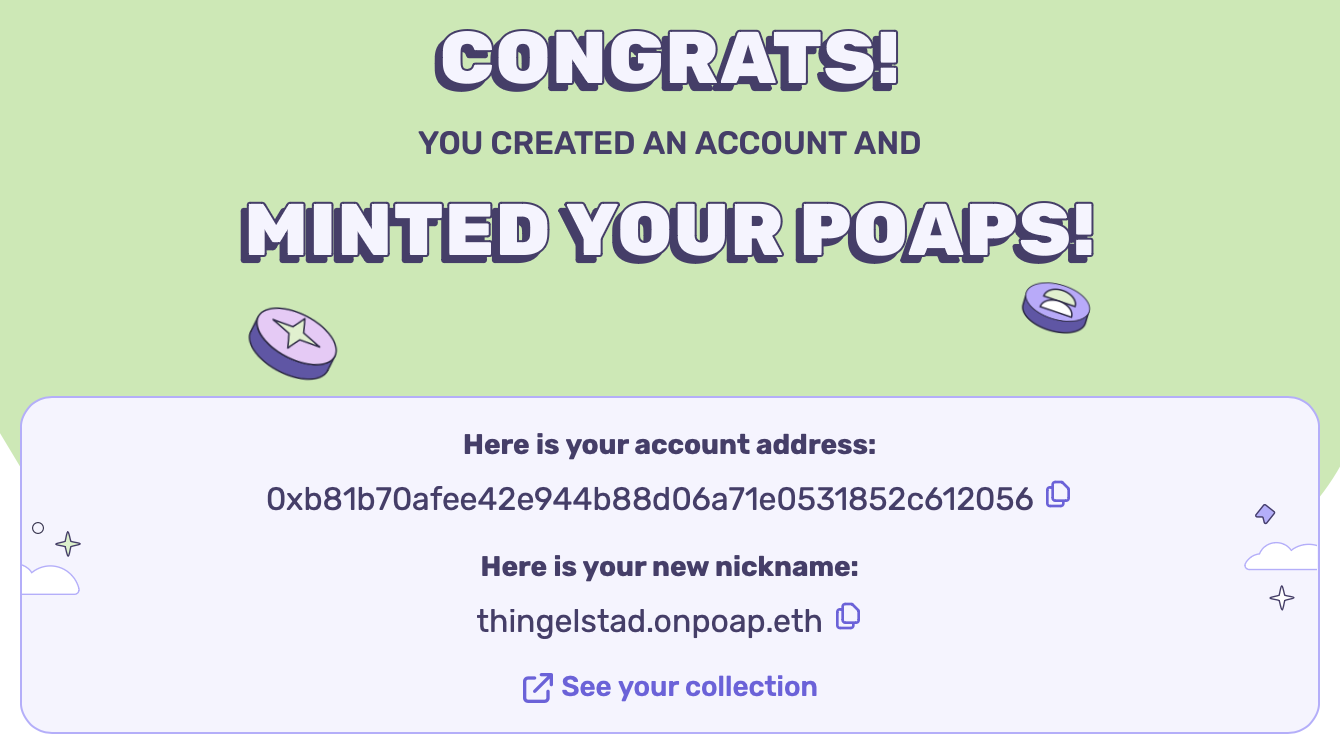

A couple weeks ago I noticed that POAP had a new beta onboarding process so I requested to be part of it, and they activated it for my 52nd Birthday drop. I gave it a try myself and I was excited to see that they had addressed everything I had wished for in this process!

Let’s take a look at the new process!

New Onboarding

Just as before, when you get a claim code you are presented with the option to get the token and you can provide a wallet address or Ethereum Name Service (ENS) name to directly mint it. You can also provide an email address to reserve the token to mint in the future.

With the new onboarding process when you provide an email address to reserve the token you get an email informing you of the next steps. Critically it presents options for you to act on!

Smartly they use language that people should easily identify with. Rather than saying “I don’t have a wallet” instead saying “Create an account”. To give this a test I chose to Create an account.

After clicking on this you are presented with a page where you can setup your account, which really means you are creating a brand new wallet address. I love that you can even specify an ENS name. I created thingelstad.onpoap.eth which got a brand new address 0xb81B…2056.

Behind the scenes this is powered by Privy to create an embedded wallet. The flow worked really well. After creating my new wallet I was then able to easily mint my POAP directly into that new wallet. Magic! 🪄

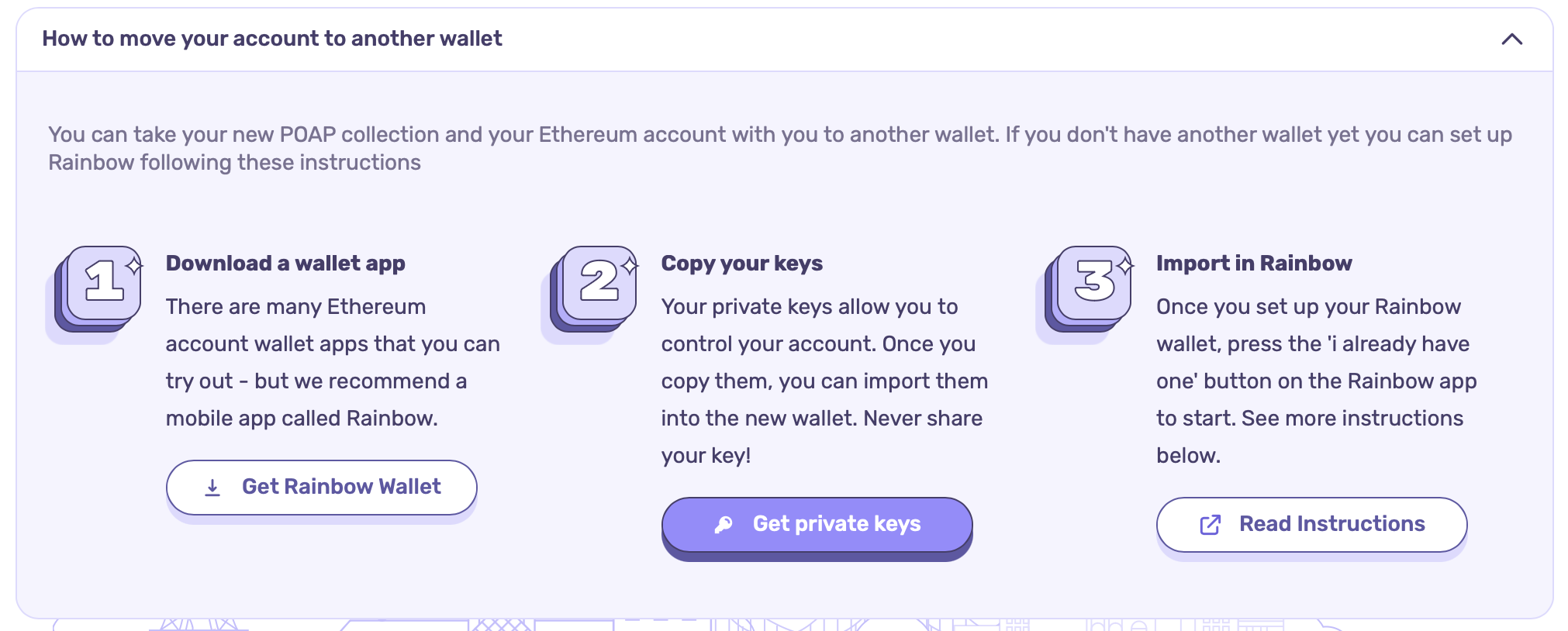

So this is great, and for a lot of people that only collect POAPs and do nothing else with crypto this is probably all that they ever need to do. But now that this wallet exists, I wanted to get access to it directly. After creating the wallet POAP send another email and this one includes those steps, and even points you to downloading Rainbow if you don’t know where to start.

I followed the directions, copied my private key, and was able to easily add the new wallet that POAP had created for me into Rainbow. 🌈

Conclusion

I’m incredibly happy about this new onboarding process. I’ve created 58 POAPs and most of my events are distributed to people that have never done anything with Ethereum before. I even created my own how to claim a POAP instructions to give people.

However, even with that it has proven too difficult for most people. With this new process, people will be able to claim and mint POAPs with nothing other than an email address! This is a big deal! I also think there are many crypto native people that may choose to do this as well. I isolate by crypto assets so I keep all my POAPs in an address just for them. Having POAP manage the wallet for me would be an even easier way to do that.

I’m eager for this new onboarding process to be the default and I think I can get rid of my “how to” page and simplify POAP distribution significantly. With this new process, POAP ease-of-use is much improved!

POAP 6968799 at SPS Web Fulfillment 2 Billion.

Bitcoin ETF Approved

Milestone day to recognize — SEC Approves Bitcoin ETFs for Everyday Investors. Bitcoin doesn’t need this to validate it or prove value but it is a big plus for the credibility of Bitcoin. BTC currently at $46,611 now.

Questions:

My 52nd Birthday POAP was highlighted in the newest This Week in POAP. 🤩

Birthday POAPs

I’ve made it a tradition since my 50th birthday to issue a POAP token for my birthday and share it as a gift from me to others to celebrate the day. I’ve now done this for three years. Each year I’ve used a POAPathon bounty to create the image and have featured a different artist each year. POAP launched POAP Family a while ago and one of the features it has is the ability to show collectors across multiple POAPs. I like how this works when you have a series of events like my birthday POAPs.

POAP 6957479 at I met Jesus in January 2024.

Today is my 52nd Birthday, but I also share my birthday with Bitcoin. Happy 15th Birthday to Bitcoin! Genesis block was mined 15 years ago. 🎉⚡️

I created a POAP to share for my 52nd Birthday! Here are five claim codes! Each link can only be used once. See how to if needed.

POAP 6955184 at Jamie Thingelstad's 52nd Birthday.

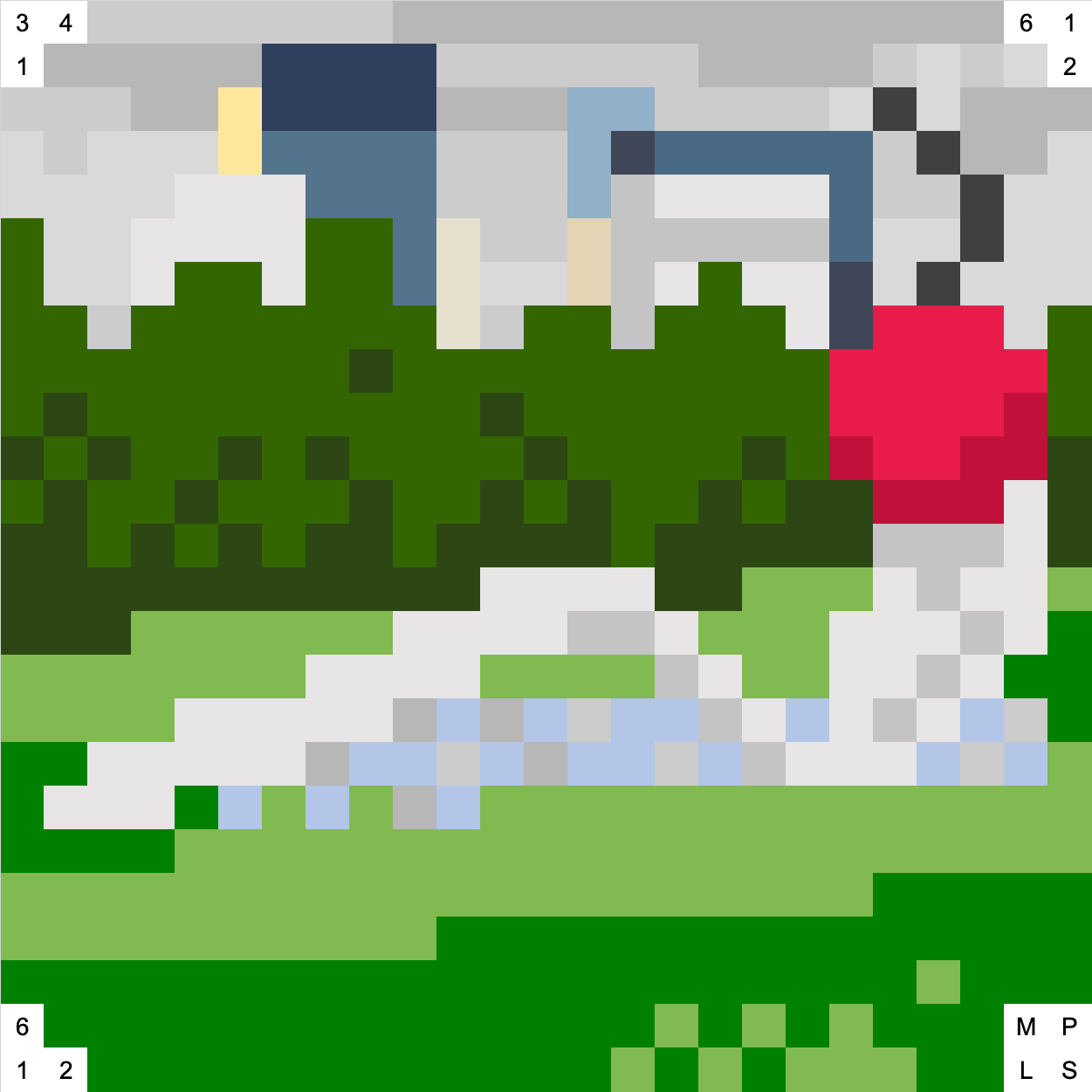

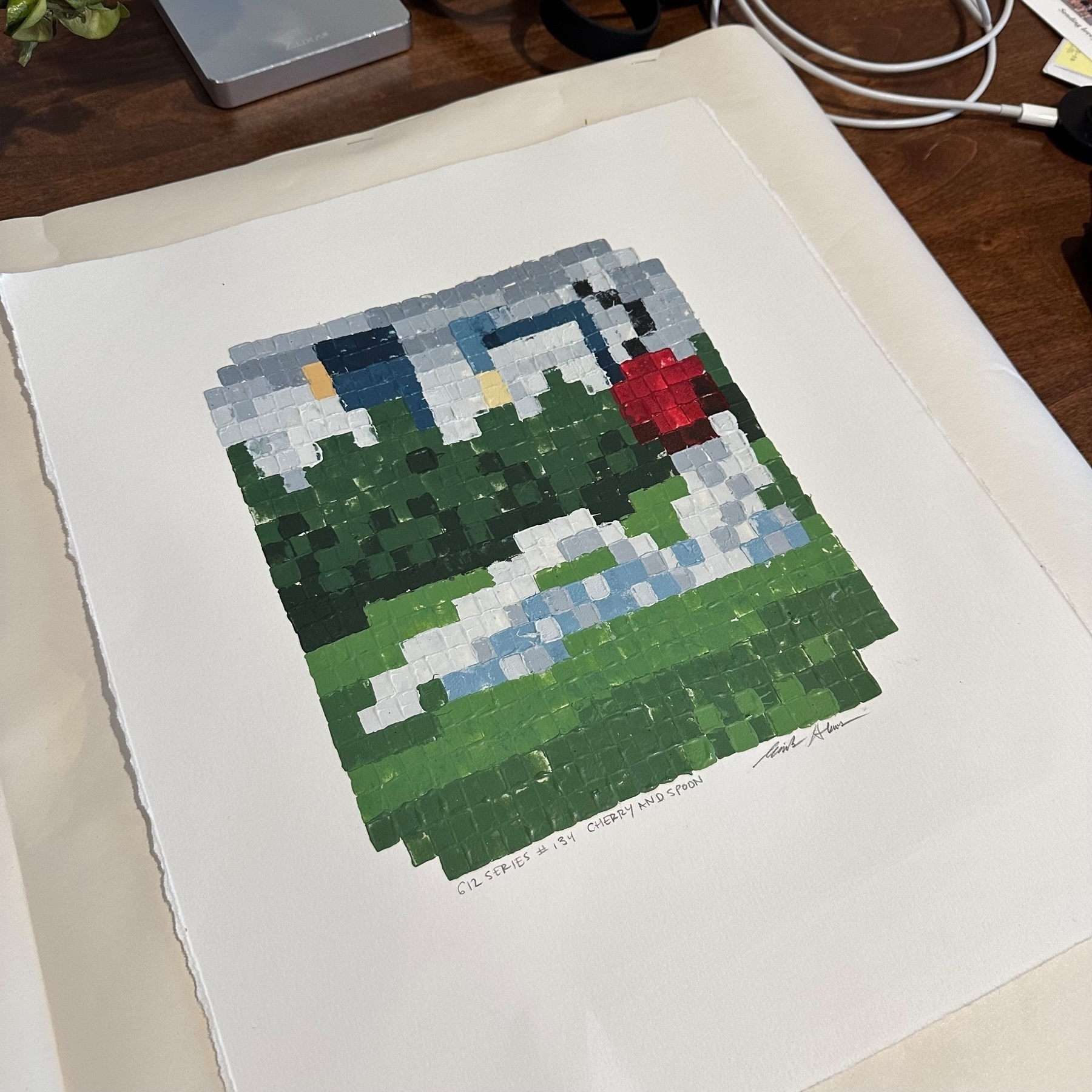

612 Series — Cherry and Spoon

My favorite local NFT project has been 612 Series by Erik Halaas of StayNftyMpls. I’ve collected 35 of them, and am the only person to have one of every landmark in the series.

To celebrate collecting all of the unique landmarks Erik asked if I would like a block painting of one of my favorites. I leaped at the opportunity and suggested one of the most iconic Minneapolis landmarks in the collection — 612 Series #134 Cerry and Spoon

Here is the NFT image.

And here is the amazing block painting!

I’m going to get this framed and likely have a print of the NFT alongside it. So very fun.

POAP just published the Year in POAP 2023 with highlights of the year. POAP is one of my favorite crypto projects! I’ve issued a bunch of them! It was great to see the POAP I made for 20 Years of Olson Family Vacations highlighted in the Year in POAP!

I was excited to be the first to claim tonight’s MN Blockchain Holiday Party POAP! Also see related POAPs.

POAP 6937660 at MNBlockchain - Holiday Party.