Crypto

Forays into blockchain, NFTs and POAPs live here. I write about minting POAP tokens at family events, celebrating Ethereum’s 10‑year anniversary by creating an NFT and even using monitoring services to keep my POAP feeds up and running.

POAP 7192127 at SPS Kubb Tourney 2024.

POAP 7180533 at First Computer Build.

POAP 7147325 at SPS TechJam 2024 - Found It!.

POAP 7147324 at SPS TechJam 2024 - Attendee.

Soon we start our trip to Ireland and I thought it would be fun to make a POAP for it. DALL-E got me started and I finalized it. I think it would be fun to share this with people we meet on our trip. We’ll see if I actually do it but I’m ready when the opportunity arises!

See list of POAPs.

POAP 7136146 at Thingelstad Ireland 2024.

POAP 7132736 at Magic Pines Summer of 2024.

POAP 7131408 at SPS Learning Leaders 2024.2.

Awesome to see my Weekly Thing Seven Year Anniversary POAP highlighted in the most recent Week in POAP today. 🤩

POAP 7123046 at Region Transfer ✔️.

I collected the ENS 7th Anniversary NFT! I continue to be a big fan of ENS and think it is one of the most important crypto projects.

Also see 6th Anniversary.

I’m looking forward to Minnesota Technology Association Tech Connect 2024 event on Wednesday. To have a little fun I created a You’ve met Jamie Thingelstad at Tech Connect 2024 POAP to share with folks that I see there. If you are at the event say Hi and I’ll give you a claim code! 🤝

POAP 7120292 at Olson Family Vacation 2024.

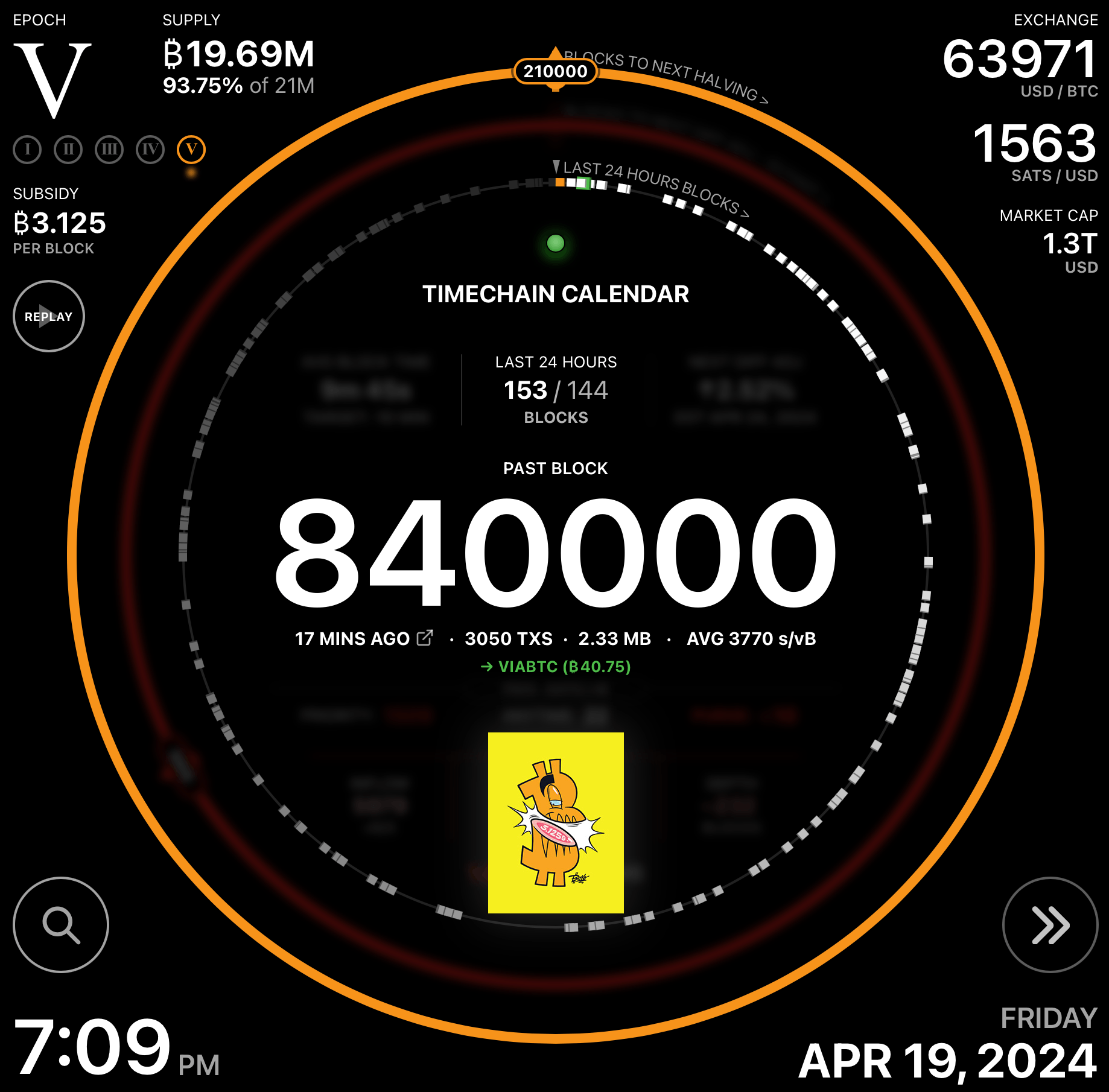

We just passed the Bitcoin halving and are now in Epoch V! What an incredible journey so far. I found Bitcoin interesting in 2014. I ultimately experimented with it but didn’t see the utility. I ignored it for years. Then played with it from time to time. I think it is likely that Bitcoin is the foundation of an entire crypto ecosystem that will grow in importance over decades.

See my blog posts mentioning bitcoin. Screenshot is from Timechain Calendar.

POAP 7104649 at Cyber Week 2023.

POAP 7099088 at SPS - Sparky AI Launch!.

POAP 7073071 at TeamSPS Pi Day 2024.